We have received further guidance on the Coronavirus Job Retention Scheme which highlights important dates and changes that may impact you in the coming weeks and months.

The full publication is available at https://www.gov.uk/government/publications/changes-to-the-coronavirus-job-retention-scheme/changes-to-the-coronavirus-job-retention-scheme

Important Dates

- The first time you will be able to make claims for days in July will be 1 July, you cannot claim for periods in July before this point.

- From 1 July, employers can bring furloughed employees back to work for any amount of time and any shift pattern, while still being able to claim CJRS grant for the hours not worked.

- 31 July is the last day that you can submit claims for periods ending on or before 30 June.

- From 1 August 2020, the level of grant will be reduced each month. To be eligible for the grant employers must pay furloughed employees 80% of their wages, up to a cap of £2,500 per month for the time they are being furloughed.

- The Coronavirus Job Retention Scheme will close on 31 October 2020.

Timetable of Changes

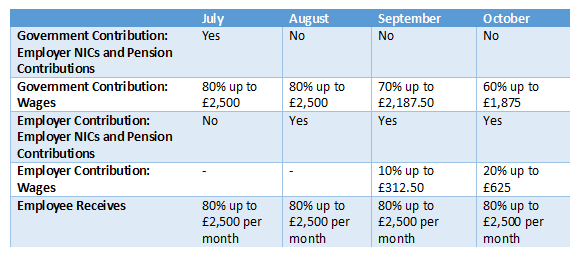

The timetable for changes to the scheme is set out below. Wage caps are proportional to the hours an employee is furloughed. For example, an employee is entitled to 60% of the £2,500 cap if they are placed on furlough for 60% of their usual hours:

- There are no changes to grant levels in June.

- For June and July, the Government will pay 80% of wages up to a cap of £2,500 for the hours the employee is on furlough, as well as employer National Insurance Contributions (ER NICS) and pension contributions for the hours the employee is on furlough. Employers will have to pay employees for the hours they work.

- For August, the Government will pay 80% of wages up to a cap of £2,500 for the hours an employee is on furlough and employers will pay ER NICs and pension contributions for the hours the employee is on furlough.

- For September, the Government will pay 70% of wages up to a cap of £2,187.50 for the hours the employee is on furlough. Employers will pay ER NICs and pension contributions and top up employees’ wages to ensure they receive 80% of their wages up to a cap of £2,500, for time they are furloughed.

- For October, the Government will pay 60% of wages up to a cap of £1,875 for the hours the employee is on furlough. Employers will pay ER NICs and pension contributions and top up employees’ wages to ensure they receive 80% of their wages up to a cap of £2,500, for time they are furloughed.

Employers will continue to able to choose to top up employee wages above the 80% total and £2,500 cap for the hours not worked at their own expense if they wish. Employers will have to pay their employees for the hours worked.

The table shows Government contribution, required employer contribution and amount employee receives where the employee is furloughed 100% of the time.

Wage caps are proportional to the house not worked.

If you have any questions regarding the scheme or need some support with applying, please do not hesitate to get in touch. Please call the Payroll team on 01454 619900 or email payroll@dunkleys.accountants and we will do what we can to assist.