HMRC is stepping up efforts to stop tax evasion relating to short-term rental property landlords who use sites such as Airbnb. Changes to Research and Development tax relief aim to lower the overall expense of innovation for UK businesses, and will now be extended to include the costs of datasets and cloud computing.

Likewise, the full expensing policy aims to encourage businesses to increase their investment in cutting-edge equipment, tools, and technology. Finally, The Government has extended the voluntary National Insurance deadline, meaning taxpayers now have until 31 July 2023 to make additional payments to help increase their state pension entitlement.

With continued inflation across many sectors, its a particularly important time to arrange financial affairs as tax-efficiently as possible.

If any of the information within this newsletter affects you or your business, please get in touch by calling 01454 619900 or emailing advice@dunkleys.accountants.

Kind regards,

Dunkley’s

HMRC is stepping up efforts to stop short-term rental property landlords from evading taxes. Landlords who have earnings from renting out their properties on sites such as Airbnb, Booking.com, VRBO, and Holiday Lettings are among those who should be aware of this campaign.

Rental income that is less than £7,500 in a tax year does not need to be disclosed in a self-assessment return (as the income is automatically exempt through the rent-a-room tax relief if the rooms are let out in your own home). However, if two people receive income from the same property, the cap is decreased to £3,750, and it does not apply to additional properties or second homes. UK short-term landlords can receive a £1,000 tax free allowance on income earned from hosting. However, this is separate to rent-a-room relief, so only one of the allowances can be used in a tax year.

HMRC will utilise information about rental properties in the UK and overseas as well as other data they have on taxpayers to identify people who may owe tax. It is important to note that if you do not make a voluntary disclosure now and HMRC finds out later, you risk facing fines or legal action.

Taxpayers can use the online digital disclosure service to provide information on earnings.

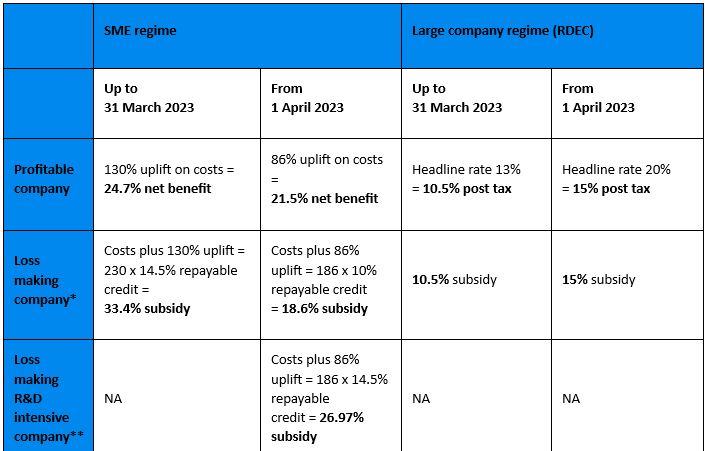

If you are a business that is investing in innovation and developing new processes, products or services, Research & Development (R&D) tax relief can provide valuable financial support. Your financial projections may depend on how the R&D tax relief regimes will operate since reforms took place from 1st April 2023.

By 2027, the government aims to have increased R&D spending to 2.4% of the country’s GDP. R&D tax relief will help to achieve this objective by lowering the expense of innovation for UK businesses. The government is also making adjustments to the claims procedure, which aim to tackle errors and potential misuse of the R&D tax relief system.

R&D expenditure categories will be extended to include the costs of datasets and cloud computing. However, there are exceptions such as when these relate to a “qualifying indirect activity” where you are including a small proportion of non-technical personnel time attributable to qualifying R&D projects.

As of April 1st tax relief are as follows:

If any of this information effects you or your business, please contact our head of tax chloe.debiaune@dunkleys.accountants

Full expensing policy aims to encourage business investment

From April 2023 to March 2026, companies can claim 100% capital allowances on qualifying plant and machinery, writing off the cost of investment in one go. The policy comes as the existing super-deduction, which provides a 130% capital allowance on qualifying plant and machinery investments (plus a 50% first-year allowance for qualifying special rate assets), ended on 31 March 2023.

Full expensing has been established in order to encourage UK businesses to increase their investments in cutting-edge equipment, tools, and technology. In 2021, business investment in the UK made up 10.0% of GDP, compared to an average of 12.5% among our international rivals.

What is plant and machinery?

Most tangible capital assets, other than land, structures and buildings, used in the course of a business are considered plant and machinery for the purposes of claiming capital allowances.

Plant and machinery that may qualify for full expensing includes (but is not limited to):

- machines such as computers, printers, lathes and planers

- office equipment such as desks and chairs

- vehicles such as vans, lorries and tractors (but not cars)

- warehousing equipment such as forklift trucks, pallet trucks, shelving and stackers

- tools such as ladders and drills

- construction equipment such as excavators, compactors, and bulldozers

- some fixtures such as kitchen and bathroom fittings and fire alarm systems in non-residential property.

Full expensing builds on the success of the super-deduction, the biggest two-year business tax cut in modern British history. As the UK recovers from the Covid-19 pandemic, this measure aims to accelerate planned investment, and reward businesses for creating the right conditions for sustained economic growth. The Chancellor said he was introducing the scheme “with an intention to make it permanent as soon as we can responsibly do so.”

Spring Budget 2023 – Full expensing – GOV.UK (www.gov.uk)

If any of this information effects you or your business, please contact our head of tax chloe.debiaune@dunkleys.accountants

The voluntary National Insurance contributions deadline has been extended to 31 July 2023, to give taxpayers more time to fill gaps in their National Insurance record. This is in response to public concerns over the prior deadline of 5 April 2023.

There is now more time for anyone with gaps in their National Insurance history dating back to April 2006 to determine whether to close the gaps to increase their new State Pension. Any payments will be made at the lower rates for the 2022–2023 tax years.

A person must have 35 qualifying years of NI contributions in order to qualify for the maximum ‘new state pension’ (received by those retiring on or after 6 April 2016). To qualify for part payment, a person must have contributed for at least 10 years, though different rules may apply for those whose NI record started before 6 April 2016. From 31 July 2023, this timeframe will revert back to the normal six years, so it will be possible to make contributions going back to the 2017/18 tax year only.

Individuals should take this opportunity to check their NI record to identify any shortfalls in their NI history, check that their record includes NI contributions paid through PAYE, self-assessment, and NI credits, and contact HMRC to have any errors corrected. It may be beneficial to make voluntary NI contributions at this time, potentially increasing the amount of state pension received.

The ICAEW has provided a useful list of actions for taxpayers to take, and a short webinar which explains these changes:

- Check your NI record

- Identify any discrepancies between NI contributions paid and those showing on HMRC’s system

- Identify any NI credits that are missing from periods in which they should have been received (eg, on receipt of universal credit or child benefit)

- Identify any shortfalls in contributions

- Contact HMRC if you think there are any errors

- Decide whether to make voluntary NI contributions

- TAXbite: Check your NIC record! | ICAEW

Deadline to top up national insurance contributions extended | ICAEW

Specific financial advice is recommended when deciding to make voluntary NI contributions.

In addition to offering specialist business advice and expert tax solutions, we can also support you with the following:

- Audit

- Making Tax Digital

- Mergers, Acquisitions and Business Sales

- Cloud Accounting

- Tax Compliance & Planning

- Outsourced Finance Team

For more information on any of our services visit www.dunkleys.accountants

and keep in touch via our social media channels below for regular updates.