Throughout October, Rishi Sunak has made a number of announcements regarding the extension of the Government’s Job Support Scheme, the doubling of the next self-employed income support grant and the support that will be available for businesses in England affected by ‘tier two’ restrictions.

The new measures include:

- The Job Support Scheme. This will be extended for six months. Employees will now only need to work 20% of their hours to be eligible. For the hours not worked, employers must only contribute 5% of their employees salary rather than the previous 33%.

- The next Self-Employment Income Support Scheme grant will be doubled. This could be worth up to £3,750, but crucially individuals will need to have been affected by reduced demand to claim. This is a significant change as with previous grants there were broader criteria and individuals could claim for any “adverse impact”.

- Businesses in England affected by ‘tier two’ restrictions can apply for new grants likely worth up to £2,100/month.

In addition to this, the Government announced a tax relief for employees who have had to work at home, either full time or part time as a result of COVID-19 restrictions. Costs such as heating, water and business calls may be covered and could equate to a relief of £6 per week.

Further details about each of these schemes and reliefs can be found below.

As always, if you need any support about the revised schemes or guidance regarding how they apply to you and your business, feel free to get in touch with a member of our team by calling 01454 619900.

How is the job support scheme changing?

The Job Support Scheme is due to replace the furlough scheme after it ends on Saturday 31 October and will run for six months. Important changes to the way it will work were announced last week. Here is a breakdown of the key facts:

- To qualify for the scheme, employees now only need to work 20% of their hours. Previously, the Government said employees would need to work a third of their usual hours. As before, employees will be paid in full by their employer for the time they work.

- For the hours employees DO NOT work, the cost will still be split three ways – but the employer will now contribute much less. When the Government originally announced the scheme, it said the hours not worked would be split three ways – a third would be covered by the state, a third by the employer and the final third would be lost by the employee. This has now changed as the employer will only need to cover 5% of the employees’ wage for the hours not worked, and 62% will be covered by the state. The employee however will still lose a third.

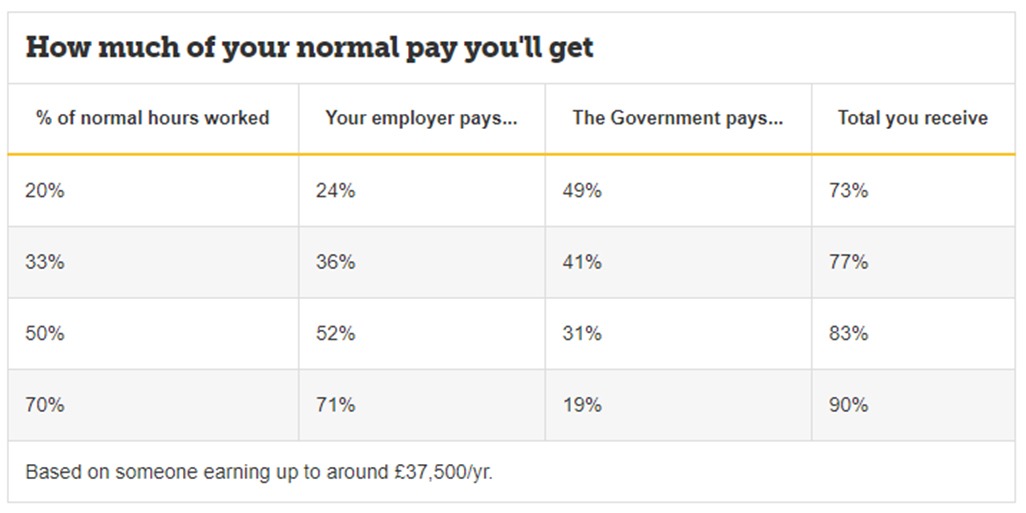

- In total, those on the scheme will now earn at least 73% of their usual pay – unless they earn enough to hit the Government’s contribution cap. The state’s contribution is capped at £1,541.75 per month (up from the maximum £697.92 per month originally). Examples of how this works in practice are shown below:

- If an employee earns LESS than £37,500 a year and is on the Job Support Scheme working at least 20% of their hours, they can receive 73% of their usual pay. This breaks down as 24% coming from the employer and 49% from the state. The remaining 27% will be lost.

- If an employee earns MORE than £37,500 a year, they could get less than 73% of their usual pay. How much less depends not only on how much the employee earns, but also whether the employers’ contributions are also capped.

- The table below shows how earning can vary depending on how many hours an employee works:

- These changes apply UK-wide – but not all employers can take part. As before, only certain employers can participate.

- Small and medium-sized businesses are eligible (the Government has not given a precise definition for this, but the usual definition of a ‘small and medium enterprise’ is one which has at least two of the following – turnover of less than £25 million, under 250 employees and gross assets of less than £12.5 million).

- Larger businesses can take part but must prove they have been adversely affected by Coronavirus and cannot pay dividends while using the scheme.

- Employers can take part regardless of whether they used the furlough scheme. Those retaining furloughed staff on shorter hours can be part of the scheme and still get the job retention bonus announced earlier this summer. Employees cannot be on a redundancy notice while taking part.

- Other eligibility requirements and rules seem to be unchanged, so to be eligible you must:

- Have been on your employer’s PAYE payroll on or before 23 September 2020.

- Those on zero-hours contracts and irregular hours WILL be eligible.

- You can go on and off the scheme. The Government says employees will be able to cycle on and off the scheme and do not have to be working the same pattern each month, but each short-term working arrangement must cover a minimum period of seven days.

For more details, please download the Government factsheet.

What additional help will the self-employed get?

The Government also announced changes to the Self-Employment Income Support Scheme (SEISS). An overview of the key details can be found below:

- There will be two more taxable SEISS grants (the scheme’s third and fourth). The third will cover the period from the start of November 2020 to the end of January 2021, and the fourth from the start of February 2021 to the end of April 2021. We still do not know when applications will open or when money will start reaching people’s bank accounts, but the Government say this will be confirmed in due course.

- The third grant will now cover 40% of trading profits for three months, capped at £3,750. This is an increase from the 20% capped at £1,875 that was due to be paid. The level of the fourth grant has yet to be set but the Government says this will happen “in due course”.

- You will need to declare that you have been affected since Sunday 1 November 2020 by reduced demand due to Coronavirus in order to claim. This is an important change as with previous grants you only had to declare that you had been “adversely affected” which in addition to a reduction in trade could, for example, have covered staff illness, extra PPE costs or if you were shielding or self-isolating.

The Government says it’s made the change as its priority is now to support self-employed people who are actively trading during the winter months. There is no detail yet on exactly how reduced demand will be defined. The Government say they are still working on the guidance.

- You must be actively trading in order to claim and you must be intending to continue to trade.

- Only those who were already eligible for the previous SEISS grants can apply. So unfortunately, there is no extension of eligibility requirements to help those who were excluded from help previously. To be eligible you must have filed a tax return for 2018/19, earn more than 50% of your total income from self-employment and your average trading profit must be no more than £50,000 a year. You DO NOT need to have applied for the previous SEISS grant to apply for this one.

To find out more, click here.

What extra cash will businesses in ‘tier two’ areas receive?

The Government also announced that grants, likely to be worth up to £2,100 a month, will be made available to firms in ‘tier two’ areas in England – for example London and Birmingham. Here are the need-to-knows:

- Firms in ‘tier two’ areas which are not legally required to close but have been adversely affected by local restrictions can apply, such as hotels and restaurants. The Government says about 150,000 businesses in total could benefit. The funds will be administered by local authorities, and its likely businesses will need to apply to their local authority to get one.

- Grants are likely to be worth up to £2,100 a month – though the exact amounts will be set by local authorities. The Government says it’s providing money to local authorities “to support cash grants of up to £2,100 a month” but it will ultimately be up to local authorities to determine what businesses can get.

However, as a guide the Government says it’s giving local authorities funding equivalent to £934 a month for properties with a rateable value of up to £15,000; £1,400 a month for properties with a rateable value of between £15,001 and £51,000; and £2,100 a month for properties with a rateable value of over £51,000. Local authorities will also get an extra 5% to cover businesses that may not be in the rates system.

- The grants will initially run until April 2021. There will however be a “review point” in January 2021.

- Businesses which have already been subject to restrictions can apply retrospectively. The Treasury says firms can apply “back to the point when the restrictions began”. However, Rishi Sunak said that any area which has been under enhanced restrictions can backdate grants to August 2020, so we are checking the exact cut-off point.

These grants are in addition to higher levels of additional business support given to local authorities moving into tier three, and also the local lockdown grants worth up to £3,000 a month that are available to businesses which are forced to close. The grants are only available in England, as business support is fully devolved. For more information on what is available in Scotland, Wales and Northern Ireland, please click on the link.

Claiming working from home tax relief

You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis, either for all or part of the week. This includes if you have to work from home because of coronavirus (COVID-19).

You cannot claim tax relief if you choose to work from home.

Additional costs include things like heating, metered water bills, home contents insurance, business calls or a new broadband connection. They do not include costs that would stay the same whether you were working at home or in an office, such as mortgage interest, rent or council tax.

You may also be able to claim tax relief on equipment you’ve bought such as a laptop, chair, or mobile phone.

How to apply

You can either claim tax relief on:

- £6 a week from 6 April 2020 (for previous tax years the rate is £4 a week) – you will not need to keep evidence of your extra costs

- The exact amount of extra costs you’ve incurred above the weekly amount – you’ll need evidence such as receipts, bills or contracts

You will get tax relief based on the rate at which you pay tax. For example, if you pay the 20% basic rate of tax and claim tax relief on £6 a week you would get £1.20 per week in tax relief (20% of £6).

To make a claim click here.